Warren Buffett in a Web3 World

Applying time-tested value investing principles to navigate the emerging digital asset landscape with clarity and conviction.

- Three-Bucket Investment Framework for digital assets

- Fundamental analysis adapted for blockchain protocols

- 60 years of investing wisdom applied to Web3

The Three-Bucket Framework

A principled approach to digital asset allocation based on fundamental analysis, not speculation.

Bitcoin (BTC)

Digital scarcity / Sound money / Store of value

Treat as a separate asset class, not 'crypto'. Long-term hold, accumulate on dips. Analogous to digital gold with monetary premium.

Alt Tokens

Productive Digital Assets

Apply fundamental analysis (the FCS framework). Look for economic moats, fee generation, capital efficiency. Higher risk, higher reward — size positions accordingly.

Cash & Stablecoins

Dry powder / Yield generation

Maintain liquidity for opportunities. Earn yield via RWA protocols and money markets. The 'margin of safety' bucket.

Sample Allocations by Investor Profile

Reader Reviews

What people are saying on Amazon

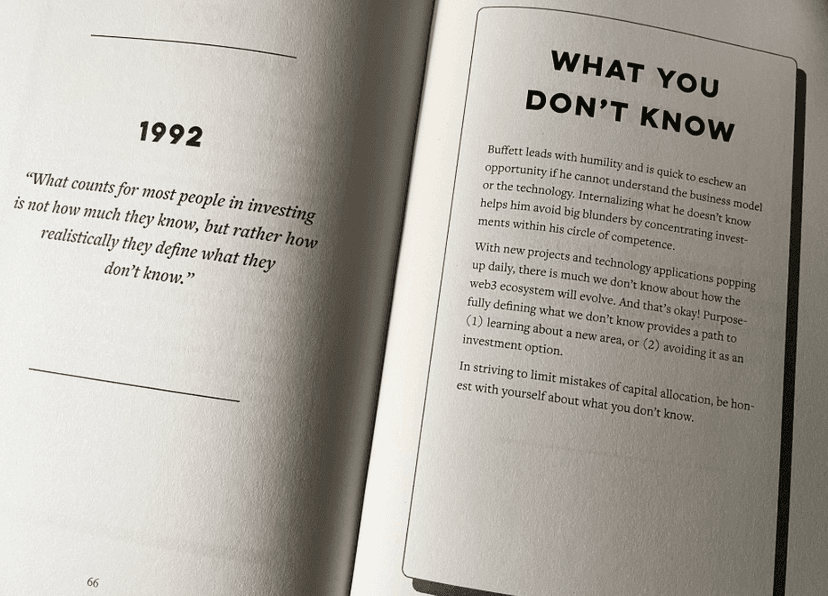

Timeless Strategies To Support Smart Web3 Investing

I loved this book for its pithy, balanced commentary and cautionary reminders about sound investing principles and how they apply in the Web3 era. Warren Buffett in a Web3 World invites discernment and serves as a great reminder whether you're curious about web3 but committed to staying with traditional investing opportunities or are looking to explore the world of cryptocurrency and blockchain in earnest.

Core Principles

Bitcoin is not crypto. It's a separate asset class with a distinct risk profile.

The question isn't whether digital assets have value — it's whether you can measure it.

In a world of infinite tokens, scarcity is the ultimate moat.

Every protocol is a business. Evaluate it like one.

About the Author

- President & Co-Founder, Block 3 Strategy Group

- Former Chief Investment Officer at (SEC-registered RIA with $650M+ in digital AUM)

- Launched four hedge funds raising $300M ; generated $5M+ in total annual revenue

- Managed $65M book of business generating $1M+ annual fees

- Originated $30M+ in crypto-backed loans ; scaled onboarding for 1,100+ HNW clients

- 10+ years in fintech and crypto; former Big 4 (KPMG) in treasury integrations

- Strategic consulting clients: Nike, PayPal, HSBC, MUFG

- Loyola Marymount University (MBA; Finance)

- Boston University (BA; Economics)

- FINRA Series 65 (Investment Advisor Representative)

- Author: "Warren Buffett in a Web3 World: Applying 60 Years of Sage Advice to Cryptocurrency, NFTs, Blockchains and More."

Newsletter BitFinance serves 19,000+ subscribers applying traditional investment principles to cryptocurrency markets.

Readers in the Wild

Join thousands applying Buffett's principles to Web3

Get Weekly Analysis

Fundamental analysis of digital assets delivered to your inbox every week.

Join 19,000+ subscribers reading BitFinance